How to report cryptocurrency gains?

Crypto are treated like investments like stocks and any capital gain/loss is reported on Schedule D.

Here are some other points to know:

- The cost basis is the amount of money invested in a cryptocurrency

- Total proceeds is the money you got from selling the cryptocurrency

- The gain/loss will be calculated based on that

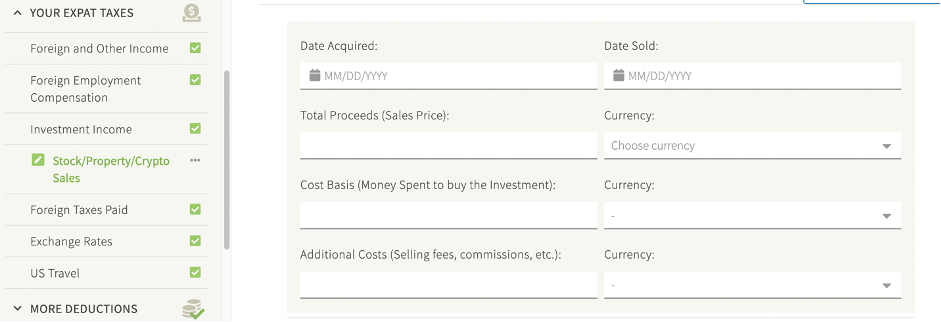

You can enter your details under Investment Income section – Stock/Property/Crypto Sales as so:

Learn more about cryptocurrency reporting for expats.

Was this Article helpful?

Let us know if you liked the post. That’s the only way we can improve.

Log In to get in touch with our Support Team

Related Articles

LogIn to get in touch

with our Support Team