Are reimbursements from my employer taxable?

Reimbursements from your employer can be considered taxable benefits or non-taxable, depending on various factors. Here are a few examples and guidelines:

Non-Taxable Reimbursements:

- Business Expenses: business expenses incurred by you in the course of performing your job are not considered income to you. These expenses should be necessary and directly related to your employment. An example would be taking an important client for dinner.

- Accountable Plan: Your employer should have an accountable plan in place. An accountable plan requires you to substantiate your expenses by providing receipts or other supporting documentation. Any excess reimbursement or allowance must be returned to your employer.

- No Personal Benefit: The reimbursement should not provide you with a personal benefit. In other words, it should cover only the actual expenses you incurred while conducting your job duties.

Typical non-taxable reimbursements can include travel expenses, mileage, meals during business travel, and other work-related costs.

Taxable Reimbursements:

Reimbursements may be considered taxable benefits if they do not meet the criteria mentioned above.

- Non-Business Expenses: If the reimbursement is for personal expenses or expenses that are not directly related to your job, treated as taxable income.

- Lack of Accountability: If your employer does not have an accountable plan in place and does not require you to substantiate your expenses, the IRS views the reimbursement as taxable.

- Excess Reimbursement: If your employer reimburses you for more than your actual expenses, the excess amount are be considered taxable income unless you return it to your employer.

- Non-Work-Related Benefits: If the reimbursement provides you with a personal benefit unrelated to your job (e.g., a reimbursement for a personal vacation)

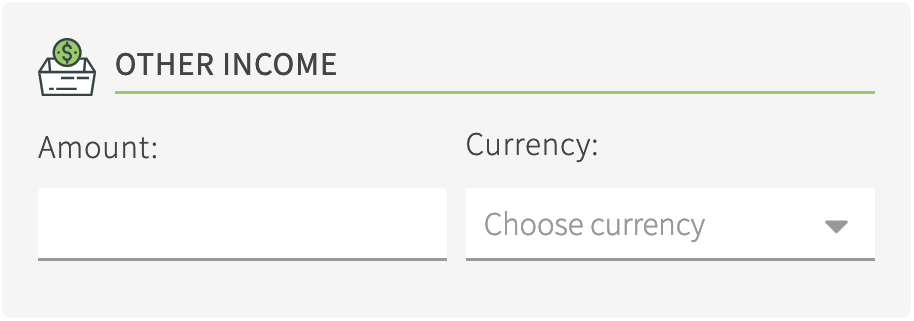

For taxable reimbursements, please select (in the ‘Foreign Employment Compensation’ section)

“I received additional compensation in addition to salaried income from this employer” and add them under the “Other Income” Category.

Was this Article helpful?

Let us know if you liked the post. That’s the only way we can improve.

Log In to get in touch with our Support Team

Related Articles

LogIn to get in touch

with our Support Team