How do I know if my tax return got approved by the IRS?

There are 3 ways on how you can check if your tax return was successfully approved by the IRS.

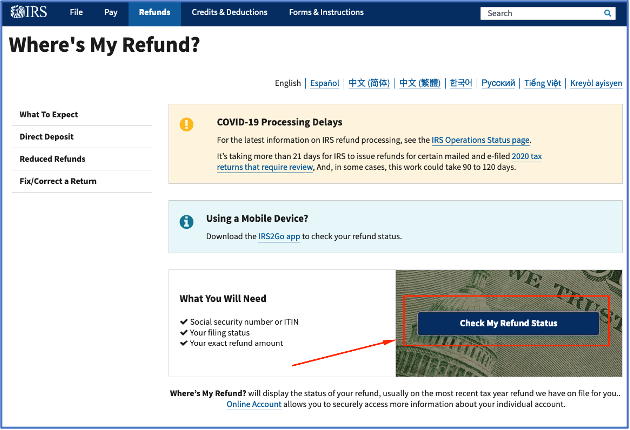

- The first thing to do is visit the IRS Where’s My Refund website

- Then you have to select “Check My Refund Status,” please see below:

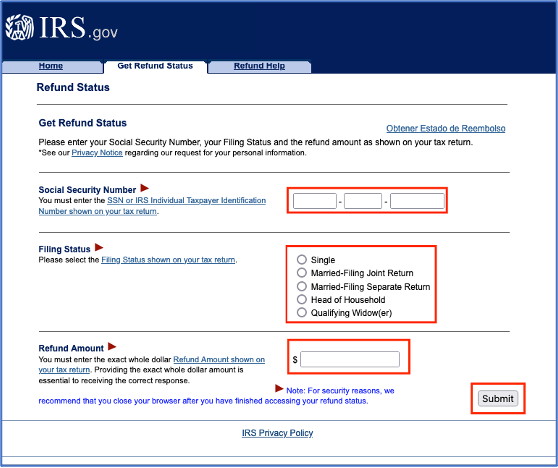

- Once selected, you would be asked for the following details make sure you have access to your tax return or you have it in hand.

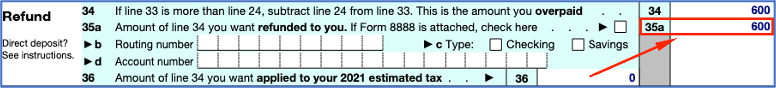

- If you are expecting a refund, you may check the amount on your 1040 Form you would see the amount of refund under line 35a, please see below:

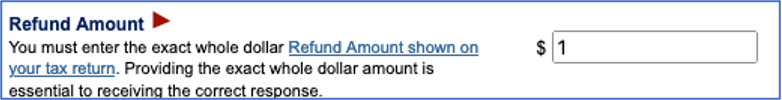

- If you are not expecting a refund, then you may enter 1 on the Refund Amount field to check it.

- Keep in mind, this just shows it was submitted, it will never be fully “processed” as there is no refund

- You also call the IRS International Hotline directly to confirm if your tax return has been approved https://www.irs.gov/help/help-with-tax-questions-international-taxpayers

We recommend this phone number: +1 267-941-1000 for international callers or overseas taxpayers, Option #1, #4, #1 to speak to an IRS Agent specifically about your case.

- By registering thru Get Transcript, you’ll be able to view, print, or download your tax return transcript. Once your tax return is available through Get Transcript tool, it means that the IRS has successfully approved it.

Was this Article helpful?

Let us know if you liked the post. That’s the only way we can improve.

Log In to get in touch with our Support Team

Related Articles

LogIn to get in touch

with our Support Team